A nighttime shot of Berlin, Germany. Photo Credit: Lukasz Czeladzinski

The German recorded music market generated nearly $1.4 billion during 2025’s first half, representing a modest 1.4% improvement from H1 2024 due in part to a physical sales decline.

Those numbers come from the European nation’s Bundesverband Musikindustrie (BVMI), which pointed specifically to €1.16 billion (currently $1.36 billion) in recorded revenue for the period. As with prior years’ reports, the sum reflects “revenues valued at retail prices” – not necessarily what items actually fetched when sold.

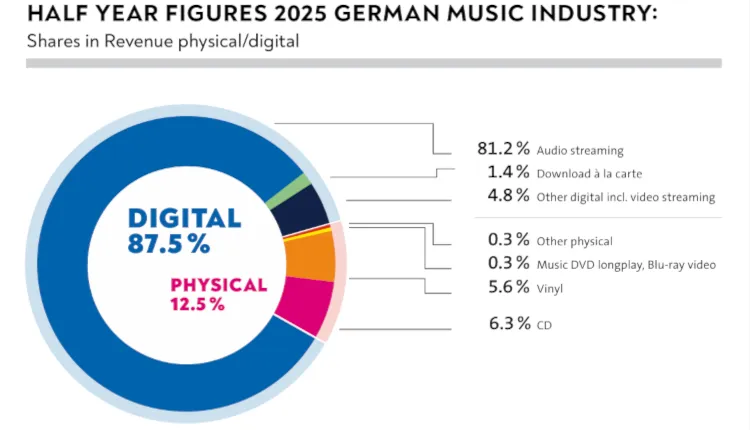

All told, digital sources accounted for 87.5% of the headline figure, with the remaining 12.5% attributable to physical formats including vinyl and CDs. Keeping the focus on digital for a moment, audio streaming fueled 81.2% of the market’s total revenue (€939.5 million/$1.1 billion).

That’s up from a 79.3% share of the German recorded music market during H1 2024. Unsurprisingly, permanent downloads’ own revenue share fell from 1.6% to 1.4% (€16.2 million/$19 million total), while other digital sources including video streaming kicked in 4.8% of revenue (up from 4.4% and coming out to €55.5 million/$65.2 million).

As mentioned – and bearing in mind overall revenue’s small improvement – streaming’s revenue-share gains stemmed in part from physical’s sales slowdown. After decades of consecutive growth, evidence has for some time been pointing to a possible vinyl plateau.

A breakdown of German music industry recorded revenue for H1 2025. Photo Credit: BVMI

In Germany, the global trend translated into a 2.2% YoY revenue-share slip for physical; in terms of straight revenue, not share, this includes a 20.1% YoY falloff for CDs (€72.9 million/$85.6 million total) and a 2.6% YoY dip for vinyl (€64.8 million/$76.1 million). Regarding across-the-board physical revenue, the decrease came in at €22.4 million/$26.3 million.

Addressing the results, BVMI chairman and CEO Florian Drücke touched on the commercial stakes associated with AI licensing in the EU.

“As an industry,” said Drücke, “we are currently in an exciting phase in which there is still potential for growth, even in developed markets such as Germany. In this environment characterised by huge technological leaps, our industry is particularly reliant on European legislators keeping an eye on the legal framework for future digital business areas.

“This currently includes the consistent continuation of the path taken with the AI Regulation in order to enable the digital licence business,” the BVMI head concluded.

Closer to the top of 2025, Germany’s GEMA, having rolled out a gen AI licensing framework last year, filed an infringement action against AI music startup Suno. Subsequently, the society reported a 4.3% YoY revenue increase for 2024, when live collections jumped but streaming’s contributions fell.

Artificial Intelligence (AI), Financials, Music Industry News

This post was originally authored and published by Dylan Smith Digital Music News via RSS Feed. Join today to get your news feed on Nationwide Report®.